8 31 2021 11 16 04 AM

Airline schedules are by definition built far into the future, typically up to 360 days ahead. During normal times this is not that difficult. Traffic growth follows predictable patterns by season and reasonably predictable growth.

Not anymore.

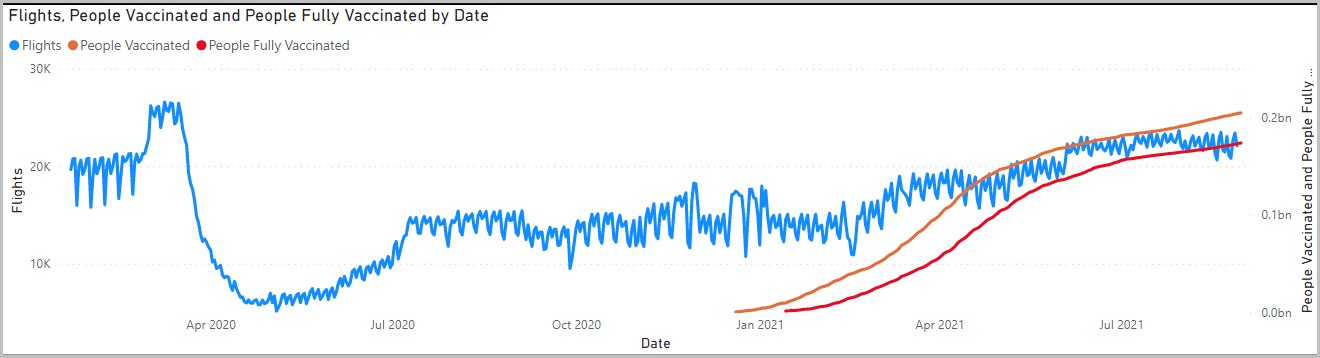

Take a look at the first chart. Based on the US vaccination rates, US airlines added flights and closely tracked the national vaccination rates. This is totally rational based on the patterns and information.

But then the “Delta” variant emerged and summer travel came to an end. Even though the economy seems to be picking up (whose numbers can you believe or trust?) air traffic declined faster than was expected.

Almost certainly US airlines are going to cut back their schedules and growth plans. There are fleet implications – do they park planes again? Is there going to be a switch to larger aircraft flying fewer frequencies? Are smaller aircraft going to remain as popular? Probably all of the above.

If you’re an airline with a state of art fleet with efficient smaller aircraft, like Delta, you’re going to have the lowest seat costs in several markets. Delta will also be able to exploit opportunities with the A321s. If you’re Southwest with mostly older 737-700s you might cut back on market growth and push MAX8s where you can best deploy them. If you’re United you try to deploy the MAX9s on more markets but perhaps with fewer frequencies. If you’re American you also try to push MAX8s where you can and expand A321 flights where opportunities open up. JetBlue, Alaska, and Hawaiian must get creative. What about Breeze? They slow down and tread carefully and where Southwest drops markets, pounce. Managing cash flow is as crucial now as it was all of last year – push back deliveries where possible and slow down rehiring.

Views: 1