MG 1275

Rolls-Royce is confident its cash costs on the Trent 1000 have peaked last year and that costs and issues with the large turbofan engine are fully under control now, the UK-maker said at its FY19 results presentation. On February 28, R-R reported a net operating loss in 2019 of GBP -852 million, nevertheless an improvement from -1.121 billion the previous year.

Civil Aerospace produced 10 percent higher revenues to GBP 8.107 billion and showed a small profit for the first time in years: 44 million compared to -162 million in 2018. Costs per engine were down GBP 0.2 million to 1.2 million per engine or GBP 0.4 million since 2017. This is mainly thanks to the XWB-84. The unit delivered 729 engines, up from 686. Of these, 510 were large turbofans, up from 469 in 2018. Services grew revenues by 14 percent to GBP 4.861 billion.

Progress on Trent 1000 redesigns

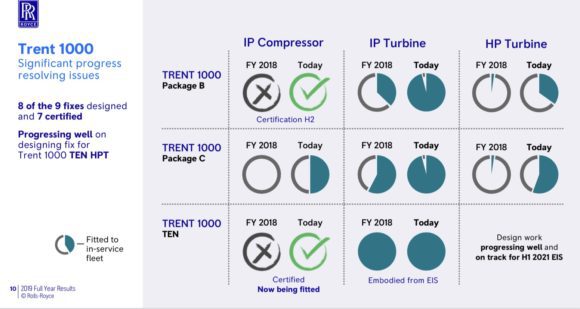

As CEO Warren East duly noted, 2019 was another year in which Trent 1000 issues weighed heavily on the company “in terms of the financial costs of returning the fleet to the levels of service our customers expect and dealing with the unacceptable disruption we have caused them.” The Derby-based OEM has now eight of nine redesigns complete and seven certified.

On the Trent 1000 Package B, the IP compressor will be certified in HY2. Repairs on the IP-turbine blades are almost done, with HP-turbine blade retrofits done some 40 percent. Package C IP-compressor-work is done 50 percent, IP-turbine some 95 percent, and HP-turbine work at 55 percent.

The revised IP-compressor for the 1000 TEN has been certified and is installed now, with no IP turbine repairs needed. This leaves only the redesign of the HP-turbine to completed, which Warren expects ready for entry into service in HY1 2021. The Trent 1000 includes 13 percent of R-R’s widebody programs.

Aircraft grounding to single-digit numbers

The Trent 1000-issues have had a profound effect on aircraft groundings of the Boeing 787-fleet, but Warren said the situation has improved according to what he said in November. This means there are still some 30 aircraft grounded for repairs in HY1 but this should drop to single digits in HY2.

In FY19, Rolls-Royce has taken a GBP 1.361 billion charge on the program, with cash costs impacted by GBP 578 million. Total cash costs will be GBP 2.4 billion for 2017-2023. They are expected to stabilize to 400-450 million for 2020 and 2021, before significantly dropping after that.

Rolls is most happy with the performance of XWB-program on the Airbus A350. The XWB-84 on the -900 should break-even by the end of this year, but East said there are reasons why R-R might decide not to pursue break-even on the XWB-97 that powers the A350-1000: “It’s possible we actually want to spend the money and have components to improve the durability and time-on-wing for service of a given engine. Because we make more profit out of that than trying to squeeze a technical profit on the [original equipment].“ Airinsight was told by Lufthansa Technik last November in Dubai about the same rationale as to why a redesign on Trent 900 HPC-blades has been put on hold: repairs are more profitable.

Dispatch reliability of the XWB-84 is 99.9 percent, with the fleet leaders having done over 3.500 flight cycles and 22.000 hours without shop visits. There have been 0.0003 unplanned removals for every 1.000 flight hours. The Trent 7000 has just reached two percent of the installed fleet, so it’s too early to tell how the program has fared.

Rolls-Royce will reduce deliveries as OEM’s have revised production rates, as Airbus has done for the A330neo. (Airbus)

Lower production rate for 2020

For 2020, Rolls-Royce is expecting a reduction in engine deliveries to 450 and 400-450 per year mid-term. This is the direct effect of Airbus and Boeing announcing production rate decreases for the A330neo/A350 and 787 programs recently.

And then there is Covid-19. With around ten percent of the widebody backlog in the Greater China region, deferral or outright cancelations could have a significant effect on sales. Rolls is actively monitoring the situation but East is unable to specify yet which specific actions will be taken.

FY20-guidance includes Group revenues to be stable to single-digit growth, with underlying operating profit expected to be up 15 percent. Core free cash flow will be at least GBP 1 billion.

Rolls-Royce had 64 percent of all wide-body gross orders in 2019 and a 55 percent overall market share. This week, it lost out to General Electric on All Nippon Airways’ order for 15 Boeing 787s plus five options. “Of course, we are disappointed to have lost out, but remember ANA will have 83 Rolls-Royce-powered 787 in its fleet. We understand that being 100 percent dependent on us is perhaps unrealistic. To have 15 plus a few options go to GE is not something that particularly surprises us. We’ll keep a deep relationship with ANA”, East said. He noted that the replacement of older widebodies is coming up in the next few years for which Rolls is perfectly placed to compete.

The UK-company upped its investments in R&D by GBP 0.1 billion to 1.1 billion in 2019, of which 55 percent was allocated to new gas-turbine engines including the UltraFan. Electrical and hybrid engines took up 4 percent last year, but this will grow to 20 percent mid-term.

In 2019, Rolls-Royce continued its restructuring and reduced headcounts by 2.900, saving GBP 269 million. By the end of this year, staff reductions should have reached 4.600 and savings GBP 400 million. To sum up the 2020 targets, East said: “I believe the coming year will mark another important step towards generating significant returns from the market positions Rolls-Royce has spent many years securing. The value embedded within our business, most obviously within our installed base of widebody engines and order book, must be fully unlocked.”

Views: 10