IMG 9237 scaled

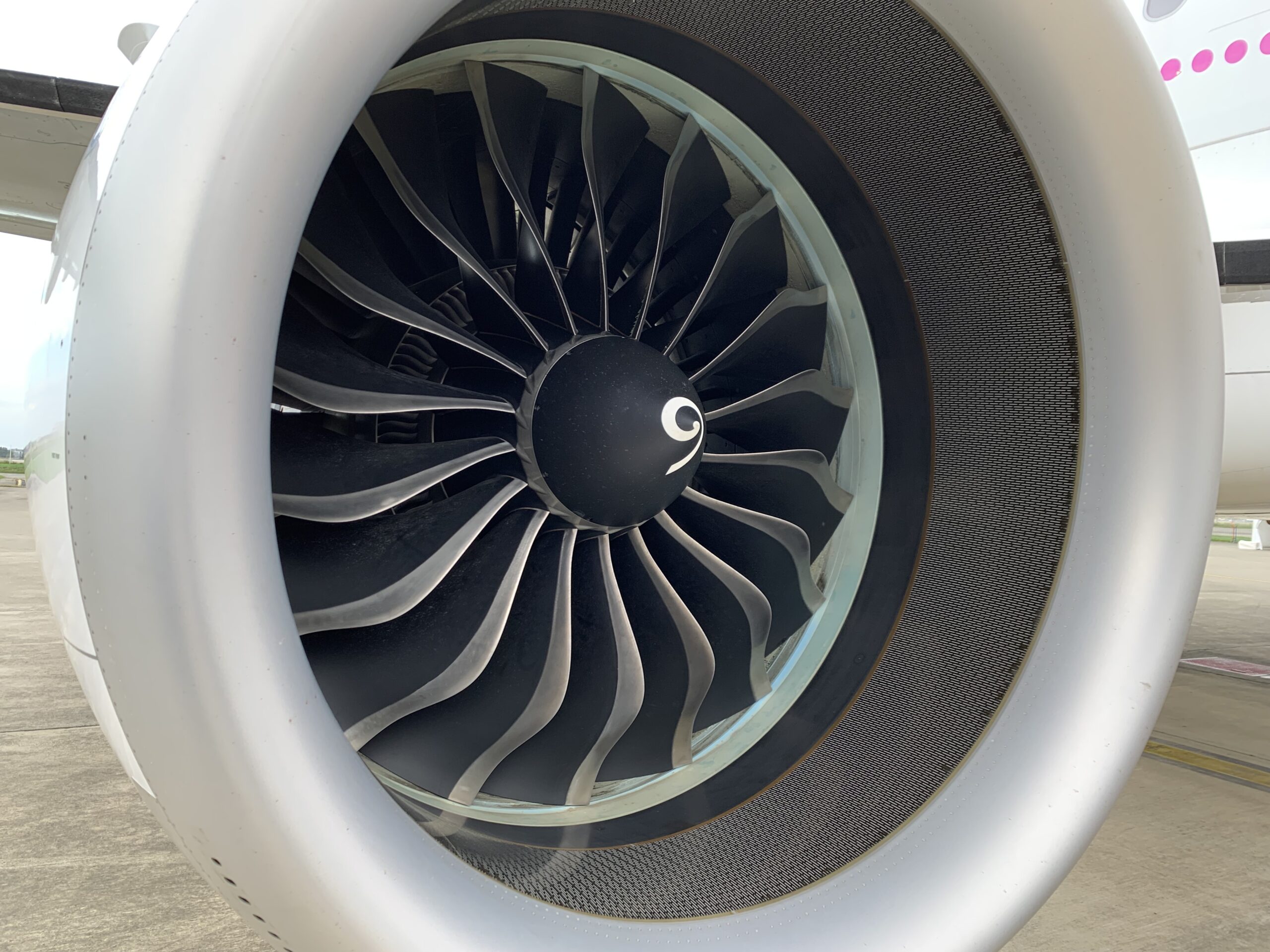

CFM International has responded positively to the request of Airbus to ramp up the production of the LEAP engines and meet higher rates in 2024. CFM-parent Safran Group confirmed this during an earnings call on April 29 on the first-quarter results. This would mean that CFM can produce sufficient engines for at least seventy A320neo family aircraft per month that Airbus has in mind for 2024. CFM ready for higher Airbus A320neo rates in 2024.

Last year, Safran CEO Olivier Andries was very skeptical about Airbus’ plans to increase the rate of the A320neo-family beyond 65 aircraft per month, which is planned from mid-2023. In July 2021, Andries said: “We are listening carefully to all of our customers: airline customer, leasing customers. And I have to say that I am not sure that the market has the appetite for such rates and if rates above 60 can be sustainable. This being said, we have agreed on the number of engines that we will deliver to Airbus in 2021 and 2022. We are discussing with them the numbers for 2023.”

Since then, the rates for 2023 have been confirmed and fit the plan of Airbus to increase the production from the current 43 aircraft per month to 65 to meet demand. Airbus CEO Guillaume Faury said in January that Airbus would make a decision this summer about a further ramp up for 2024 to seventy neo’s and even 74.

Safran now has changed its position. Andries offered no details of the exact number that CFM has promised to supply in 2024 but said that it answered positively to Airbus’s request. He said this is consistent with the commitment on rates that CFM took in 2019 before the Covid-crisis. Back then, Airbus produced sixty neo’s per month and CFM delivered 1.736 LEAPs, including the -1B for the Boeing MAX.

During its Capital Markets Day in December, Safran said that CFM will increase LEAP production to 2.000 engines in 2023 and higher if needed, helping the program to reach gross breakeven margins in 2025. With Boeing saying this week that it will keep the production of the MAX at a rate of 31 for the time being and prefers to stabilize the program, CFM could apply its capacity to Airbus. The European airframer is expected to give an update on its production rate during the Q1 earnings call on May 4.

Safran provided only limited financial results of Q1 today, reporting consolidated revenues of €4.094 billion, up 21.8 percent from the same period last year. Of this, €1.942 billion came from the Aerospace Propulsion segment, which delivered 239 LEAP engines (Q1 2021: 188), fifteen CFM56s (26), plus 170 helicopter and high-thrust engines for military aircraft. Civil aftermarket revenues were 53 percent up from last year, driven by strong demand for CFM56 spare parts.

Equipment and Defense produced €1.716 billion in revenues, up from €1.464 billion, and Aircraft Interiors revenues of €409 million (€313 million). For the A320neo family, Safran delivered 1.106 emergency slides and 141 engine nacelles, for the A330 twelve nacelles, and for the A350 ten landing gear sets, with none to Boeing for the 787. Also delivered were 346 Business Class seats and 71 lavatories for the A350.

Sanctions on Russia affect revenues by two percent

Following the sanctions on Russia, to which Safran fully complies, the OEM expects to lose around two percent of its total sales. It no longer offers service to some thousand CFM56 and LEAP engines there were operated by Russian customers. Twelve engines that were serviced by Shannon Engine Support have been stranded. Deliveries of the SaM146 engines for the Sukhoi SuperJet have been stopped. Engine deliveries for helicopter programs have also stopped, as have part supplies to Irkut for the MC-21 airliner.

Safran used to source fifty percent of its titanium requirement from VSMPO AVISMA. While supplies for this year have been secured, the company is working on alternative suppliers. The French company will implement additional and rigorous cost savings to compensate for the estimated 150 basis points impact that the situation in Russia has on its recurring operating margins.

In its full-year guidance, Safran expects revenues of €18 to 18.2 billion and a recurring operating margin of thirteen percent. Free cash flow should be around €2.0 billion. The guidance depends on the geopolitical situation, supply chain issues and inflation, and the pace at which traffic recovers in China. The recertification of the Boeing MAX will have a positive effect on CFM’s outlook in the medium and longer term.

Views: 43