20190521 French Bee Economy JTGenter 31

The US travel industry saw a much-desired and needed V-shaped recovery. The pandemic allowed the industry to do a reset. But that reset has left long-tailed impacts. Arguably, the most significant effect was the loss of skilled people. The commercial aviation silo retired its most expensive and experienced workers. The effect continues to reverberate. Since travel is a service industry, people need to provide the service. Currently, travel experiences leave a lot to be desired regarding service.

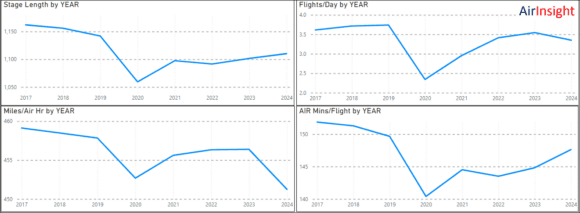

What about harder data points? Looking at DoT data, we see that airlines are flying at longer stage lengths while flights per day peaked. In sympathy with longer stages, flight times rose. Interestingly, the average speed dropped, extending flight minutes.

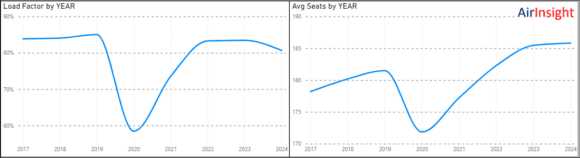

Looking at load factors and the average number of seats per flight, we see load factors softened in 1Q24, while the trend to deploy larger aircraft continues apace.

The larger aircraft item is an important data point. Alaska Airlines is now mainly a MoM operator. Southwest has over 50% of its fleet at 172 seats. Larger aircraft offer better economics than smaller aircraft.

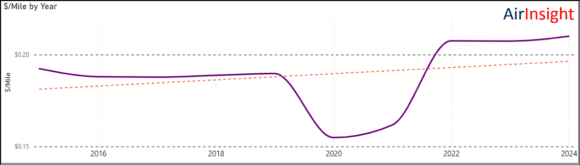

Using a different dataset, the DB1B, we see that the average fare has risen considerably since the pandemic. The trendline shows a steady rise, but post-pandemic is almost like a step change.

In summary:

- Travelers are spending more time flying as flights are slowed down

- With fewer fights and high load factors on larger aircraft

- And paying more for the experience

It’s a cocktail that does not go well with lower service levels.

Views: 7