A new generation of engines for narrow-bodied aircraft will enter service later this decade. Unlike prior generations, however, the manufacturers have diverged in their use of technology, resulting in two distinctly different configurations. Pratt & Whitney has chosen a geared turbofan configuration, while CFM International, a joint venture of GE and Safran Group’s Snecma business unit, has chosen a more conventional direct-drive configuration with a two-stage high-pressure turbine.

Both engines have multiple aircraft applications, offer lower fuel burn, lower emissions and lower noise than today’s engines. Each of the new narrow-body engines – LEAP from CFM International and the PW1000G from Pratt & Whitney, also promise equal or better maintenance costs than today’s benchmark. In this article, we will examine how these two engines will compare and contrast with respect to maintenance, and how they will utilize innovations in technology and design to meet their maintenance cost objectives.

LEAP from CFM International

The LEAP engine from CFM International is an all-new engine designed to replace the venerable CFM56 used on the Boeing 737NG and Airbus A320 families. This engine incorporates innovative technologies from CFM parent company GE, particularly from the GE90 and GEnx engine programs.

Source: CFM International

Several advanced technologies have been applied to LEAP. One of the most notable is the 18-blade 3-D woven composite fan and composite fan case, which reduce weight, extend durability and using more advanced aerodynamics, reduce both fuel burn and noise. The LEAP fan, built using resin transfer molding (RTM), provides an 11:1 bypass ratio, represents the first use of composite fan technology in the single-aisle market. CFM has the benefit of more than 26 million flight hours of experience gained on the GE90, but RTM is an even newer technology, wherein the blades are woven in three dimensions rather than built up with layers of composite plies.

The engine core also features anti-FOD (Foreign Object Damage) technology, which inward-facing Variable Bleed Valve doors and a buried High-Pressure Compressor inlet that combine to create a virtual FOD free core.

The 10-stage High-Pressure Compressor has a 22:1 pressure ratio, helping to minimize fuel burn. A new, lean-burn combustor will provide low NOx emissions and has been designed for durability. The new two-stage High-Pressure Turbine section adds advanced coatings for cooling metal parts that will enable the same metal temperatures as today’s engines despite hotter gas path temperatures. The design of the system includes third-generation three-dimensional aerodynamics as well as active clearance controls to maintain high engine performance.

THE PW1000G FROM PRATT & WHITNEY

The PurePower 1000G engine from Pratt & Whitney features a fan drive gear system that allows the fan to operate at lower speeds than the low-pressure compressor and turbine. This increases the by-pass ratio and results in a significant improvement in fuel consumption, emissions, and noise.

Source: Pratt & Whitney

Using a geared configuration, the PW1000G is the first ultra-high bypass ratio turbofan, with a bypass ratio of 12.2:1. Featuring a light-weight bi-metallic aerodynamically shaped fan shrouded by a composite fan case, the efficiency of the fan, lower fan pressure ratios, and lower operating speeds provide a significant increase in propulsive efficiency and fuel economy.

The gear, or fan-drive gear system, is the heart of the difference for this geared turbofan design. PW has designed a durable reduction gear system, with no life-limited parts, capable of handling the higher thrust of a commercial engine without a significant weight penalty.

A new core also contributes to increased efficiency. The low-pressure compressor has been designed for high-speed operations, reducing the number of stages required and significantly reducing parts counts to reduce maintenance costs. The high-pressure compressor has an eight-stage design, with advanced aerodynamics and a tied-shaft rotor. It utilizes blisks, which are integrated-bladed rotors, with ten on-wing blend locations that facilitate easy maintenance.

The Talon X combustor is a third-generation high-efficiency lean-burn combustor that reduces NOx emissions by 50% to CAEP/6 standards. The High-Pressure Turbine is a two-stage design with advanced aerodynamics, advanced sealing and cooling, advanced materials for increased durability, and fewer airfoils than prior designs. The Low-Pressure Turbine has been optimized for high-speed operations and has a reduced parts count for maintenance cost savings.

PERFORMANCE IMPROVEMENTS ARE SIGNIFICANT

The CFM LEAP will be the replacement for the CFM 56, offered on the Airbus A320neo, Boeing 737Max and the Chinese COMAC C919. The PW1000G will be offered on the A320neo family, replacing the IAE V2500, and has been chosen to power the Bombardier CSeries, Irkut MS-21, and Mitsubishi Regional Jet.

The manufacturers have each promised up to a 16% reduction in fuel burn for the new engines, which will be introduced in 2013 on the CSeries for the GTF and in 2016 on the A320neo for the LEAP. Each will offer an advanced combustor with a 50% reduction in NOx emissions from CAEP/6 levels. Each will also be significantly quieter than today’s engines, with a 15dB reduction on A320 neo, which means both engines will make less than half the noise produced by today’s engines (remember, the decibel scale is logarithmic and each 10db of noise is twice as loud). PW and CFM say the noise footprint is reduced by 75%.

One area of difference, however, is maintenance cost with CFM projecting equivalent cost to the CFM56-5B for the LEAP and Pratt & Whitney is promising a significant reduction to maintenance costs over the life of the engine than current products. While we have heard from various industry sources that PW’s has targeted maintenance costs 20% lower than today’s V2500 engine, PW has not officially published a specific target for the PW1000G series.

MAINTENANCE COSTS ARE IMPORTANT TO OEMS AS WELL AS AIRLINES

With more than half of new engines under “power-by-the-hour” maintenance contracts, the reliability of an engine will directly impact the profitability of the program. As the payment from the customer is fixed, improvements in engine reliability will fall directly to the bottom line of the engine manufacturer.

We examine each element of the new technology engines and compare them with each other and the existing benchmark, the CFM56-5B. An examination of US DOT Form 41 data indicates that the CFM56-5B has lower maintenance costs than the competing IAE V2500. The V2500, however, burns less fuel. Airlines evaluate the trade-offs between fuel burn and maintenance cost in making their engine selection between two excellent products today, and a similar decision will be required as GTF and LEAP enter the market.

ENGINE CONFIGURATIONS

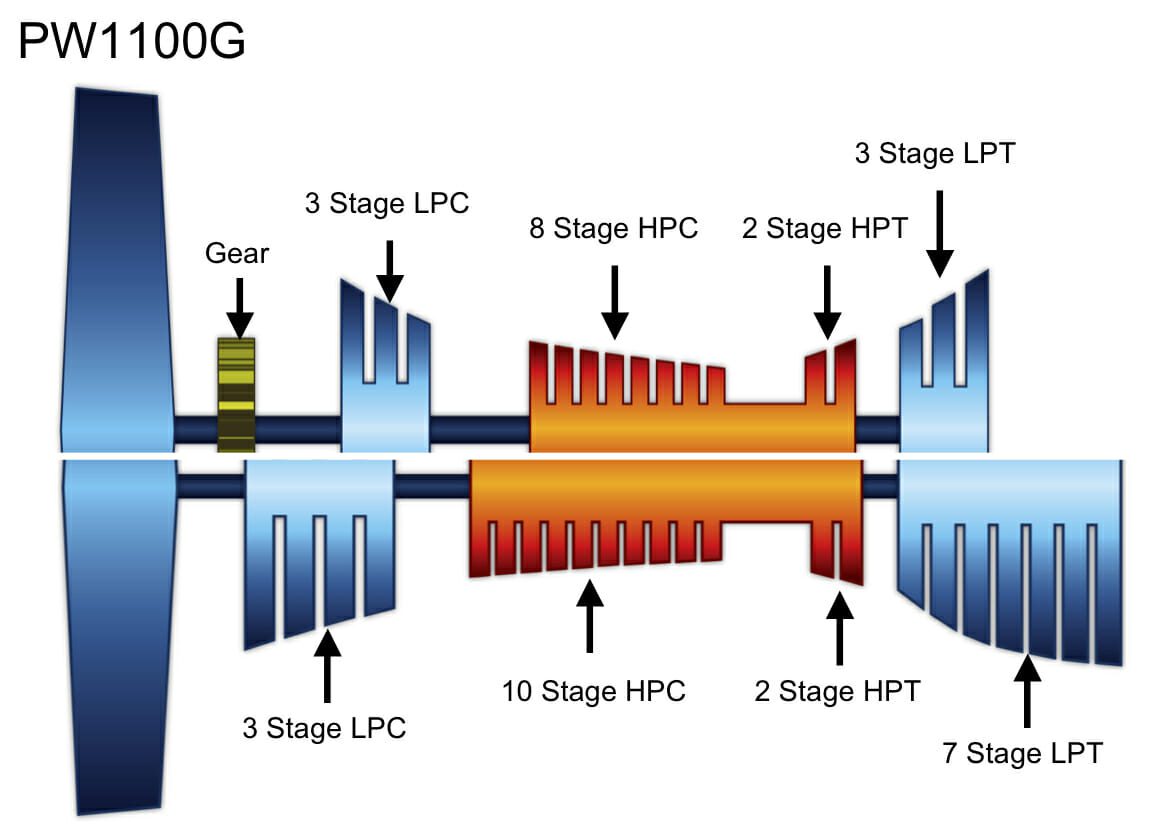

The PW1000G uses a geared turbofan configuration, adding a gearbox that enables the fan to turn slower than the remainder of the engine, which rotates at a higher speed to optimize performance. The CFM LEAP utilizes a more conventional direct-drive configuration.

PW1000G utilizes a Geared Fan configuration

PW1000G utilizes a Geared Fan configuration

CFM LEAP uses a direct drive configuration with a 2-stage High-Pressure Turbine Source: CFM

CFM LEAP uses a direct drive configuration with a 2-stage High-Pressure Turbine Source: CFM

The difference in configurations also impacts the number of stages required in the booster, high-pressure compressor, high-pressure turbine and low-pressure turbine required to achieve the projected performance. The following table compares the number of stages in each engine section for the PW1100G and CFM LEAP for Airbus A320neo and compares them to the existing CFM56-5B used on the Airbus A320.

Both newer engines will utilize a two-stage High-Pressure Turbine rather than a single-stage HPT on the CFM56. By adding a gearbox, PW was able to reduce the number of engine stages while achieving its fuel burn goal, while LEAP adds stages to achieve its fuel burn goal. The LEAP, when compared with the CFM56, adds stages in the HPC, HPT and LPT sections to achieve its performance improvements. The PW1000G, while adding a gearbox, has fewer sections than CFM56 in the HPC and LPT to achieve its performance improvements, relying instead on higher rotational speeds enabled by the geared configuration.

COMPARING THE LEAP VERSUS GTF FROM A MAINTENANCE PERSPECTIVE Based on each manufacturer’s claim, with LEAP projected to have equal maintenance costs with the CFM56, and the PW1000G to be significantly lower than today’s engines, we should find the rationale for the PW1000G to be lower in maintenance costs than the LEAP when we examine the details.

Such a comparison is best accomplished by looking at the engine from front to back on a section by section basis. A diagram comparing the engine configurations is shown below.

Source: Pratt & Whitney

AirInsight estimates that the PW1000G will have between 1,500-3,000 fewer airfoils, six fewer stages, and about the same number of life-limited parts in its configuration when compared with the latest information we’ve obtained on the LEAP. GE has indicated that its count of airfoil difference is in the 1,500 range, based on their comparative estimates, but was unable to provide us with projected airfoil counts for the LEAP, citing the proprietary nature of an engine still in design. Pratt & Whitney similarly would not provide detailed airfoil counts but indicated that the difference could be significantly higher than GE’s estimate. While neither engine is totally final, designs are reasonably well established at this point in the development process, and the information we’ve gleaned indicates a significant difference between the two engines in airfoil counts. While the manufacturers are keeping their blade counts proprietary, clearly, there are significantly fewer airfoils in the PW GTF than in the LEAP. As parts count is a driver of the maintenance cost, the key question then becomes how the parts used in each engine will wear.

The GE-designed core for the LEAP featuring coating technology that will enable parts to not only withstand a 200-degree increase in engine path temperatures while keeping metal temperatures constant but also improve their wear performance. Pratt & Whitney features fewer parts with higher rotation speeds to optimize engine performance that will also utilize advanced technologies to improve wear performance. We may need to wait until engines are in service to determine how well both engines meet their goals, as with increased temperatures, and in the case of the GTF, higher rotational speed, wear patterns may be different than today’s components. But both companies are betting their futures, and their PBTH contracts, on their new technologies.

(Steven Udvar-Hazy, CEO of Air Lease Corp., told the ISTAT conference in Barcelona the two engines will have to be in service six to eight years before the industry truly understands the promises/performances by PW and CFM.)

So far, in initial test engines, wear has been lower than projected for the GTF, a positive sign that their technologies will be successful. LEAP, which is scheduled for later entry into service, has not reached the stage in development for testing the complete engine, although some component tests have been completed. Ultimately, the key to maintenance success will be how well the new materials, coatings, and cooling processes work in high cycle environments.

Traditionally, the core of an aircraft engine accounts for over 90% of maintenance costs, with this highest proportion in high-pressure sections. We don’t see a break from this trend in either new engine, particularly since both will utilize two-stage rather than a single-stage high-pressure turbines to generate thermal efficiency.

Our comparison begins at the front of the engine, working rearward.

FAN SECTION: The LEAP has an 18 blade composite fan, compared with a 24 blade metallic fan for the CFM56-7B and 36 or the CFM56-5B. The GTF will utilize an 18 blade bi-metallic fan. Each will have a larger fan than the CFM56, with a 78” fan for LEAP and 81” fan for PW1000G on the A320neo.

Comparing the two approaches, composites materials will be slightly more expensive than the bi-metallic blades, but will also be lighter, and potentially more durable.

LEAP also incorporates foreign-object damage (FOD) reduction technology in its design, with a centrifugal design that ejects FOD through doors. PW’s design, using a translating sleeve, provides an alternative mechanism to block FOD, and cites their lower fan pressure ratio as a factor in not bringing in as much debris into the engine. Each of these technologies will help lower maintenance costs, as eliminating FOD reduces engine damage.

Each fan design should be more efficient than today’s engine and we believe that maintenance costs for the fan section, typically about 5% of total engine maintenance, will be roughly equivalent between the new engines. Advantage: DRAW.

GEARBOX: As LEAP has no gearbox, it clearly has an advantage in maintenance costs over the GTF. The maintenance cost of this gearbox is projected to be low, as the gearbox has only seven moving parts and a robust lubrication system to minimize wear. Even though the costs for gearbox inspections should not be as significant as some initially feared, because of PW’s innovative technology, gears do require periodic maintenance. We estimate the gearbox will require about 2-3% of total engine maintenance cost. Advantage: LEAP.

The majority of maintenance costs, as with all turbofans, will come from the core:

LOW-PRESSURE COMPRESSOR: Both engines have a 3 stage LPC, but the GTF will have fewer airfoils, based on the preliminary design information we’ve been provided by both companies. However, the GTF will be rotating much faster. We would expect similar to perhaps marginally lower maintenance costs for GTF in this section given the difference in the number of airfoils. Advantage: DRAW

HIGH-PRESSURE COMPRESSOR: The GTF has 8 stages versus 10 or LEAP, and about one-third fewer airfoils than the LEAP in this section. While the PW1000G will rotate slightly faster than LEAP, we still expect, given the significant difference in airfoils, lower maintenance costs for GTF in this section, as these are both high-speed compressors. Advantage GTF.

COMBUSTOR: Both engines utilize new technology combustors that have similar characteristics, including dual annular designs. While both will be more efficient than prior versions, they will each be more complex than today’s technology, and likely more expensive to replace. Pratt & Whitney cites its third-generation Talon combustor while GE cites their advanced technology TAPS combustor, introduced on their advanced wide-body engines. Advantage: DRAW.

HIGH-PRESSURE TURBINE: In this section, with high operating temperatures, wear can be significant, and this part of the core can account for 60% of engine maintenance costs. The key question that is how well the specialized coatings and materials used in the LEAP will protect the engine, which is expected to have gas path temperatures 200 degrees hotter than the CFM56. If these coatings work well and improve the durability of the components despite the higher temperatures, LEAP should be able to maintain reliability equivalent to its current parts. But we expect such parts, adding coating and cooling technologies, will be more expensive than existing parts without such coatings.

We have been provided data on operating temperatures and pressure ratios from both Airbus and Pratt & Whitney that do not match with respect to the PW1000G engine and will utilize data provided by Pratt & Whitney in our analysis. PW should have the most current data and what data we’ve been provided appear to better match the underlying physics when examining differences between the engines.

Engine performance comes from a blend of propulsive efficiency (generated by the fan) and thermal efficiency generated by the core. Roughly 50% of modern engine performance is dictated by each element. The GTF, with a larger, slower turning fan, has an advantage in propulsive efficiency, and the LEAP, to provide the equivalent fuel burn improvement, would need higher thermal efficiency. That would require a hotter burning engine. At equivalent temperatures, I would expect about a net 2-3% differential in fuel burn between the engines, given the difference in bypass ratio and fan efficiency, and thereby conclude that to provide equivalent fuel burn performance, the LEAP will need to run at hotter temperatures and have higher pressure ratios than the GTF.

The GTF is expected to run about 70 degrees hotter than the CFM56, and PW believes it can maintain reliability while keeping metal temperatures equivalent to its design. While these gas path temperatures are 60-130 degrees lower than LEAP, these higher temperatures can still impact wear. In addition, the GTF will be rotating at a much higher speed than the LEAP, which helps optimize performance, but the rotational dynamics could also adversely impact wear and tear on parts. PW cites a proprietary cooling technology to accommodate both higher temperatures and minimize the impacts of rotational dynamics to minimize wear, but PW won’t describe those technologies, citing them as a trade secret and relative competitive advantage.

Coatings and cooling mechanism must work well to ensure durability in either engine. But in looking a blend of temperatures, airfoils and rotation speed, we believe the high-pressure turbine maintenance costs will be substantially higher for both engines than the single-stage CFM56. PW has experience with a two-stage HPT, as the V2500 has a proven two-stage design. With anticipated lower operating temperatures and fewer airfoils, we would expect an advantage for the PW1000G. Advantage: GTF.

LOW-PRESSURE TURBINE: This section has a major difference, with 3 stages for the GTF and 7 stages for LEAP. In terms of parts, this translates to about two thirds fewer airfoils for GTF than LEAP, a significant difference. Even with higher rotational speeds, the GTF should achieve lower costs in this section than the CFM. Advantage GTF.

The bottom line: The GTF adds a gearbox, it has, by our estimates, between 1,500 to 3,000 fewer airfoils, six fewer stages, about the same number of life-limited parts, and runs 120 degrees cooler than the LEAP, but rotates many of its components at much higher speeds. CFM and GE have utilized technologies from GE90 and GEnx that include specialized coatings to improve the reliability of parts, and PW has also re-designed its parts for high-speed operations in hotter environments.

Given the huge difference in the number of airfoils to be maintained, CFM’s parts would need to be twice as durable as PWs to maintain maintenance cost parity. While we do expect significant improvements from CFM and GE with their advanced coatings, we expect that PW will also utilize the advanced technology to generate significant improvements in durability for its components. Because each manufacturer will use advanced materials and coatings in each engine, we don’t expect that durability differences to be high enough to make up for the number of additional airfoils that would require repair or replacement.

Our preliminary estimates indicate that the PW1000G should have an advantage in maintenance costs over LEAP, and could reach the 10-20% level, based on the latest configuration data we have obtained from each manufacturer and other industry sources. Of course, we are still early in the game, and our forecast of cost is based on the limited preliminary data available to us. The GTF is in engine testing for a 2013 introduction, and the first LEAP engine has not yet been fully built, so things can, and likely will, change. But, ceteris paribus, we would expect the GTF to have an advantage in maintenance costs over LEAP based on two factors – fewer parts and slightly lower temperatures.

The real question is whether either engine can really deliver on their goals of matching the maintenance cost of the CFM56-5B or being 20% lower than the V2500, the benchmarks on which their projections are based. Given higher temperatures and pressure ratios, I believe it will be difficult for either engine to maintain today’s levels of maintenance costs, despite new coatings and cooling technologies. Even if the parts wear as well or better than the last generation, those parts will likely be more expensive, given their special coatings.

While the GTF should retain an advantage over LEAP, the aggressive maintenance goals set by each engine manufacturer will be difficult to meet. History has shown that both companies will meet their commitments, either with innovative technology or reducing margins if the innovations don’t work. Looking at the innovative technology in these engines, commercial terms may well come into play.

Was I a customer, I would hold the engine manufacturers to their statements, and ask for firm maintenance cost guarantees. Only time will tell, but physics is physics, and holding the line or reducing maintenance costs for new technology engines won’t be an easy task.

Views: 517

It should read: Tie-Shaft Rotor in the HPC section.

As for the LPC pressure ratio in the LEAP-X: 2.6 in the LPC and 22 in the HPC would mean that the core alone would have a pressure ratio of well above 54 (you have to consider some pressure loss between the LPC and the HPC). The 2.6 pressure ratio should be the pressure ratio of the fan+LPC. The fan should have a pressure ratio north of 1.4, so the LPC is somewhere between 1.8 and 1.9 – that should be doable with three stages.

Furthermore, I guess the core speeds should not be much different: turbine efficiency comes (mainly) via speed, so in order to get a good core efficiency, the LEAP core should run at comparable speeds than the GTF.

It seems pretty clear to me that because of the temperature differences, the LEAP represents the very mature and highly engineered tail of a product cycle.

The GTF is a new product, and may or may not meet its claims in full. But as the path for GTF (higher temperature) is clear, the GTF architecture certainly seems to have a much brighter future in the 8-15 year timeframe.

Duly noted and corrected on LPC section – three should work, and I think they could get 2.0 from 3 stage booster.

Regards,

Ernie

LLPs are a substantial part of ownership cost, but I do not see any mention of LLP lives or LLP reserve rate ($/cycle to be reserved toward LLP replacement) for the two engines. Can you update with this info?

I mentioned in the article that the engines had a similar number of LLPs, by our count 24 for LEAP and 25 for GTF. My net is that the LLPs will likely be just about equal in cost between the two engines, as this is an area the engine companies have been working hard to improve in both life and cost. Regards, Ernie

You need to recount the number of LLPs for each engine.

Example

Fan = 1

LPC = 3

HPC = 10

HPT = 2

LPT = 7

total = 23

GTF

Fan = 1

LPC = 3

HPC = 8

HPT = 2

LPT = 3

Total = 17

Thus GTF is less than LEAP

The question of the costs associated to the gear box is not clear, there is little experience of geared turbofans mainly in business aviation and regional jets. In this case the amount of power is huge and could be closer to the turboprops gearboxes (lower power but higher torque), but for the GTF the gearbox is inside the engine with much more difficult access. On the other side you need to consider the auxiliary systems needed such as oil pump, oil cooler, piping, etc, that also play an important role.

My counts, based on info from CFM and PW are different than you suggest. I show 24 for LEAP and 25 for GTF. Manufacturer counts differ from yours, but were provided on background not for publication, so I won’t list them, but have verified their accuracy with each manufacturer. Regards,

Ernie

I have to believe that with the GTF game changing architecture, PW will always be able to insert the same incremental materials and process technologies as GE to stay ahead of the LEAP in efficiency, durability and maintenance cost. However, the impact of each manufacturer’s commercial policy will be the ultimate discriminator..

If I were a betting man, perhaps 60-40 market share, advantage to the GTF?

LEAP X has 4 stage LPC in stead of 3?

What is not mentioned here has to do with reality of engine life understanding. The GTF is running with main shaft bearing dn higher than any previous production experience. Bearing dn is a rough measure of the severity of the application. The HP shaft bearing dn is over 3.3 million which is higher than all previous bearings (2.5 million is the old limit) in the commercial engine industry. I am not aware of any advances in bearing technology that would warrant this increase. The GTF runs on the critical speed of the HP shaft at take-off power. This is not normally done as slight changes in imbalance could have a large effect on shaft motion amplitudes affecting bearings and seal life in an adverse way and raise the stresses in all the supporting structure. The HP shaft bearing system is complex with three bearings and one being an inter shaft bearing with counter rotating shafts. The complexity makes predicting vibration amplitudes less accurate and will affect bearing and seal life. Technology has improved in blades in the outer part of the engine, but technology has not improved in what supports the shafting yet higher rotational speeds are being run. Thorough development testing is required with many levels of imbalance to prove the inner hardware can provide the necessary life. It does not appear there is much of this “good old” endurance testing that will find any weaknesses in these tribological components.

I expect there will be some surprises that cause design iterations. Engine reliability estimates are not that simple.

im an aviation maintenance student. been doing a research on future GTE trends and I find your article very helpful. 🙂

I’m in MRO business with GE and Pratt engines…

In terms of technology, both companies have their own way of cooling turbine blades. Some choose to have blades to be able to withstand high temp and some choose to deliver more air to cooling turbine blades. Any methods work fine as long as the temp of the turbine blades can be kept low enough. Hot section of the engines is always a challenge to repair. I wouldn’t go into this as it’s way too complicated.

But Pratt has always been successful in fixing problems and introducing advance materials very carefully. GE development is impressive but maybe too fast..

The GTF has much lesser stages, smaller blades, smaller combustor and thus, logically it will burn lesser fuel.

As for the gearbox, I have faith in Pratt testing for durability and material testing.

Good luck to both engines…its for the environment !

Little new technology tweaks, trying to stay hip with coatings and composites, bet both don’t know composites or RTM well enough, trying to keep up. Same old junky F101 core. The more things change, the more they stay the same.